Estimated reading time: 4 minutes

With the different types of asset classes and their unique characteristics, what should you consider when building a portfolio?

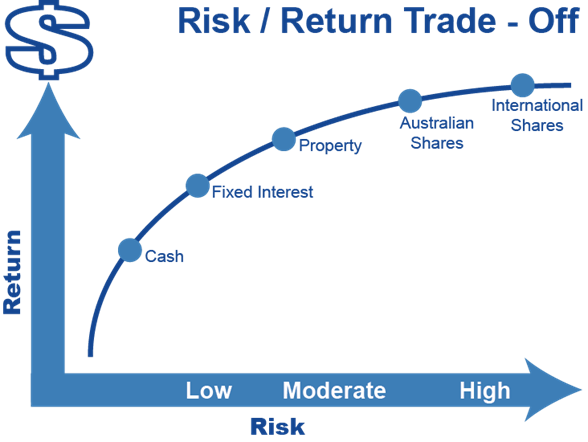

Risk vs Return is the guiding principle of all investing. For you to earn a return for investing your money, you need to take on a level of risk. Secondly, for you to earn a higher return, you need to be taking on a higher level of risk.

What exactly does risk mean for investments?

Risk can be defined in many different ways, but at its most basic form, it is the chance of losing money on your investment. This means that when you are taking high risk, you have a higher chance of losing money, whilst a low risk, is a lower chance of losing money.

To explain risk with reference to asset classes, Shares are a high risk investment because there is a chance the underlying company can go bankrupt, or perform poorly and the share price goes down. Whereas a low risk investment such as cash, there is generally no risk of losing your money, with some cash holdings having government guarantees in place up to certain limits.

So why would you take risk if it means potentially losing money?

It is important to take a level of risk that is in line with what your goals are, as well as how well you can tolerate investment losses. As can be seen in the attached picture, long term performance of higher risk assets have performed in excess of low risk assets, but this comes at significant volatility and chance of loss in the short term.

Source: Infocus

Therefore, a common framework of choosing investments and the asset classes that suit you will involve identifying what your goals and objectives are, and then to align your investments in line with this timeframe. This is also overlaid by how well you tolerate risk, and if you cannot tolerate the risk of loss, you will reduce risk taken in a portfolio.

Diversification and reducing risk in your portfolio:

Diversification is one of the key principles for building effective investment portfolios. At its core, diversification is aiming to maximise your return for the level of risk you take.

To achieve this, an investor may choose a variety of asset classes, such as a portfolio consisting of cash, fixed interest, shares, property and infrastructure as well as alternative assets. Within each asset class the investor will also, choose a variety of different assets that aim to spread the risk across different industries, geographically and individual assets. For further reading on diversification, you should consider reading the Modern Portfolio Theory by Harry Markowitz in the 1950s.

Diversification doesn’t eliminate risk entirely, but a well-crafted, diversified portfolio can significantly reduce the risk associated with investing in a single asset or concentrated group of assets.

If you would like to discuss this further, or if you are not sure whether your portfolio is adequately diversified, please reach out. We would love to help you in tailoring your portfolios to maximise the chances of you reaching your life goals.

Author: Harrison Trippett

Disclosures:

- Past performance is not a reliable indicator of future performance.

- This information has been compiled from sources considered to be reliable, but is not guaranteed.